Investment Management

THE NEW STANDARD OF PORTFOLIO MANAGEMENT

Our team of professionals unlocks a number of choices for your portfolio. We offer experienced guidance for selecting alternative investments, separately managed and unified managed accounts, structured products and options, along with traditional offerings such as equities, fixed income, annuities, mutual funds, and exchange-traded funds.

We sift through the many investment strategies, managers, and products to uncover those we believe to be judged by potential for growth, capital preservation, income, and other factors. We then further refine that pool to reveal options suited to your specific needs, placing your best interests first in all decision-making.

More than

700

Client Relationships

Over

1,400

Managed Accounts

Over

$500

Million AUM

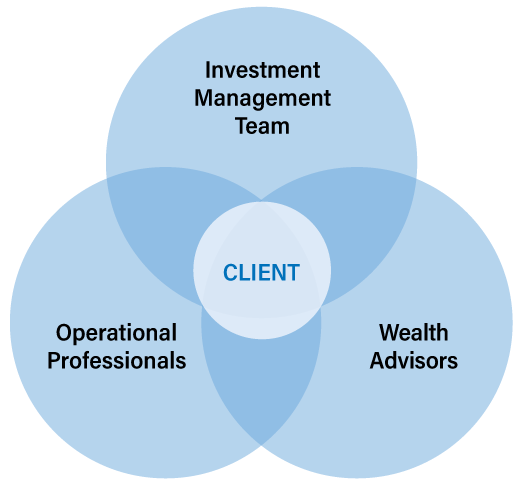

A Collaborative Approach

Our Investment Management Team works closely with our advisors and our operational professionals to support them in serving each of our client’s needs regardless of their account structure, size, and goals. They are dedicated to sharing resources such as capital market research and insights, and highly sophisticated investment strategies that are customized for each client to assist them in achieving and exceeding their expectations.

Investment Management Team Services

Investment Management Solutions

Tailored sophisticated investment strategies, on-going management, and reviewing all are included as part of the investment management solutions service.

Smart Cash Management

Quantitative driven cash management strategy which enables clients and advisors to create a customizable income distribution within an investment strategy.

Portfolio Analysis & Review

Multiple reporting capabilities for an in-depth review of the investor’s current allocation offering commentary and potential recommendations.

Investment Policy Construction

At the individual or institutional investor level, IPS construction is crucial in dictating the investor’s profile and determining the relevant investment strategy constraints that will provide clients with the best possible investment experience

Capital Market Commentary

Weekly, monthly, quarterly, and annual market reports that summarize market events and activities as well as provides context to relevant economic data releases.

Investment Research & Insights

Investment research and insights reports, which not only summarize but dive into opportunities within various markets. In addition, advisors and clients can request various research reports on stocks, bonds, mutual funds, EFF’s, etc.

Technology Driven

Technology is at the heart of the investment process for our Investment Management Team. Utilizing the latest technology advancements is crucial for the long term success of the practice. Technologies used by the team include and are not limited to: Investment Management Center (Raymond James), Aladdin (Blackrock), Prisms (Goldman Sachs), Eikon (Reuters), Portfolio Insights (JP Morgan), and many more.