Maximize Your Giving Impact

Whether you call it philanthropy, charitable giving or donating, we help you make the most of your generosity. One of life’s greatest rewards is sharing your wealth with others, and it seems there are as many good reasons to give as there are ways to give. Perhaps you just want to save on taxes or maybe you want to leave a lasting legacy or establish a family tradition of giving that can instill these values for generations to come.

“Remember that the happiest people are not those getting more, but those giving more.”

— H. Jackson Brown Jr.

Qualified Charitable Distributions from an IRA

Traditional IRA owners can make required distributions directly to qualified charitable organizations. The money is excluded from adjusted gross income, potentially reducing taxes. This means you can enjoy helping a worthy cause while simultaneously reducing your taxable income.

Gifting Stocks

In most cases, if you have appreciated stocks or mutual funds in a taxable investment portfolio, you have a significant opportunity to give more, simplify the giving process, potentially pay less in taxes, and improve your personal cash flow. The key is to donate these appreciated securities before you sell them.

5 Benefits of Donating Appreciated Stock

- The tax deduction for the market value of the donation

- Federal capital gains taxes savings in the amount you otherwise would have incurred from selling the stock outright

- An opportunity to rebalance your portfolio in line with your financial plan

- As an alternative to gifting cash, you can donate stock and then repurchase identical shares, often resulting in a step up in cost basis

- The ability to benefit a charity by the full appreciated amount of the stock

Charitable Estate Planning

Typically, there are three places assets can transfer to upon death: family/friends, charity, or the government. If you have exposure to the federal estate tax, thoughtful planning may significantly reduce or potentially eliminate the estate tax liability and enable you to redirect those reduced taxes for charitable impact.

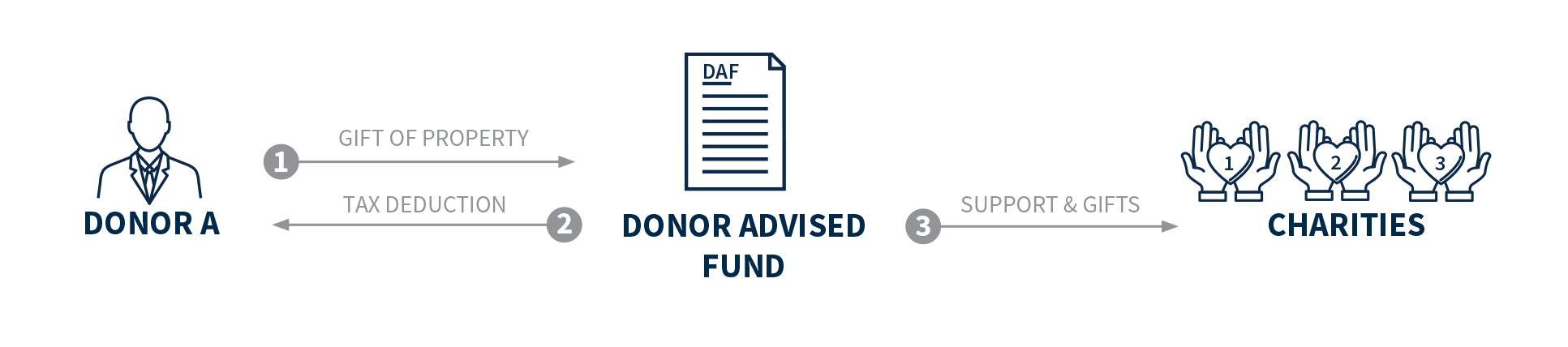

Donor Advised Funds (DAFs)

Similar to a private foundation, a donor advised fund lets you donate to your favorite charities and receive immediate tax benefits and deductions, but with less expense and setup.

5 Benefits of Donor Advised Funds

- No capital gains tax on long-term appreciated assets that are gifted

- Immediate tax deduction for the full market value of the gift* for most assets

- No excise taxes, unlike a private foundation

- Assets donated are no longer part of the estate value

- No minimum annual distribution requirement for DAF account holders

*Any amount that can’t be deducted in the current year can be carried over and deducted for up to five succeeding years.

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Aspire Wealth Group and not necessarily those of Raymond James. Every investor’s situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional. Donors are urged to consult their attorneys, accountants or tax advisors with respect to questions relating to the deductibility of various types of contributions to a Donor-Advised Fund for federal and state tax purposes.

To learn more about the potential risks and benefits of Donor Advised Funds, please contact us.