From withdrawals to conversions, taxes in retirement can be a balancing act.

Retirement is right around the corner, and those final five years before you clock out for good are some of the most important in your financial journey.

The benefits of a purpose-driven life don’t dissipate when you retire. Rather, without the imposed daily and weekly structures of the working world, it may be even more important to find purpose during this distinct stage of life.

The 2026 Social Security cost-of-living adjustment (COLA) has been announced.

With open enrollment season upon us, ask yourself a few questions to make sure you’re getting the most from Medicare.

Simple steps to help build your financial foundation.

In no circumstance is end-of-life care an easy conversation, but if you ever find yourself needing to make those tough decisions for a loved one, it’s comforting to know what they want.

Imagine spending years diligently saving for retirement, only to realize there are strict rules about when and how you must start withdrawing that money.

As you move through retirement, it’s important to set time aside to reflect on how you’re doing. While most people often focus on their health and finances, it’s equally as important to think about other areas of your life as you approach the midpoint of your retirement.

Retirement is an exciting new chapter, but for many, it also brings the challenge of staying socially connected.

Choosing to work with a financial advisor can make a positive difference in your current and future life – and even for the next generations of your family. Your goals of building and preserving wealth, enjoying a comfortable retirement, and leaving a legacy are dependent on how well your financial matters are managed.

It’s an election year, which means you can expect to hear presidential candidates being asked about their plan for preventing Social Security from going bankrupt.

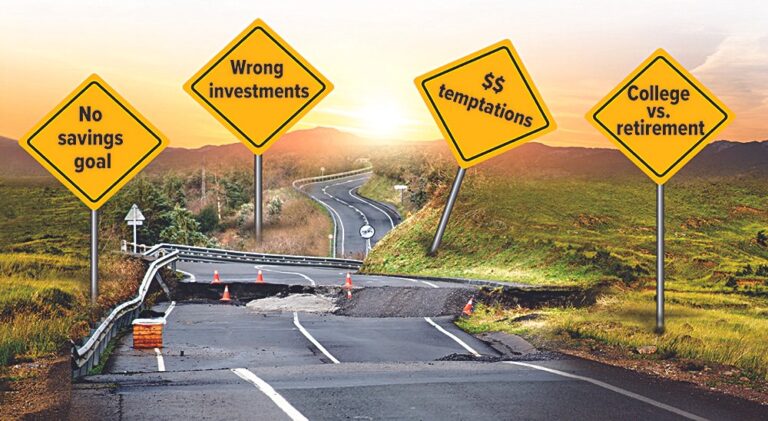

On the road to retirement, be on the lookout for hazards that can hamper your progress. Here are five potential risks that can slow you down.

More than 338,000 Americans relocated for retirement last year – a 44% increase from 2022 – and about a quarter of those retirees moved to a different state. According to the online moving-services marketplace Hire A Helper’s latest annual report, Florida is the number one destination for retirees, claiming 11% of movers across state lines. South Carolina comes in at a close second and New Jersey third, with Texas and Washington rounding out the top five. Let’s explore what’s drawing retirees to these destinations.

To handle payments for a disabled senior, it’s not enough to put powers of attorney, medical directives or guardianship arrangements in place.

For people looking to build a balanced retirement savings portfolio, a Roth IRA can serve as a great companion to an employer plan such as a 401(k). But if you earn too much money, you may not qualify to invest fully – or at all – in a Roth IRA. And no matter how much you earn, you may find that contribution limits prevent you from building as fat a fund as you’d like. Fortunately, there are “backdoor” strategies that may help you get around these limitations. Here’s what you need to know.

Age may just be a number, but when it comes to retirement, it matters. A recent survey by the Employee Benefit Research Institute found that only 11% of workers plan to retire before the age of 60. But with the right preparation, you can create a retirement plan that will provide you with financial resources and the freedom to pursue your passions, whether you flip the switch at 65, 60 or sooner.

You know how important it is to plan for your retirement, but where do you begin? One of your first steps should be to estimate how much income you’ll need to fund your retirement. That’s not as easy as it sounds, because retirement planning is not an exact science. Your specific needs depend on your goals and many other factors.

This year, about 65 million Americans will receive over one trillion dollars in Social Security benefits. If you’re planning to join that total and claim your benefits, timing, strategy and sound decisions can all help you maximize the outcome for your household. When and how you claim, your marital status, your health, and even whether you have dependents can all affect what benefits you receive.

It’s heartbreaking to hear stories of people losing money (even their life savings) as a result of fraud or financial exploitation, especially if they are older and financially vulnerable. In fact, it’s quite common. You know your parents could be at risk, and you want to protect them, but how?

You want to retire comfortably when the time comes. You also want to help your child go to college. So how do you juggle the two? The truth is, saving for your retirement and your child’s education at the same time can be a challenge. But take heart — you may be able to reach both goals if you make some smart choices now.

Thinking about opening or contributing to a Roth IRA? Learn more about the benefits of this type of retirement account and your possible eligibility to contribute. The key benefits of Roth IRAs include…

If you’re close to or in retirement, recent inflation has likely been unnerving, particularly given that stock markets have experienced significant volatility since early 2022. That is, you’re looking at higher prices while parts of your portfolio have lost value and your purchasing power has slipped. So, how should you respond to protect your retirement goals? When it comes to investing, the best strategy generally is to…

The bulk of Social Security benefits go to retirees, but Social Security is much more than a retirement program. Most Americans are protected by the Old-Age, Survivors, and Disability Insurance (OASDI) program — the official name of Social Security — throughout their lives.

Many individuals who are saving for retirement aim to have at least $1 million in their retirement accounts when they exit the workforce. But retirement savings aren’t a one-size-fits-all matter. Instead, the amount you’ll need depends on a variety of factors, including your lifestyle, specific financial obligations, future plans, and health needs.

If you and your spouse are looking for a way to build your retirement savings but one of you is not working, you might consider funding a spousal IRA. This could be the same IRA that the spouse contributed to while working or it could be a new account.

You’ve made a financial plan for retirement, but what about a fun plan? According to an article by The Senior, “Your Retirement | Don’t be a bored Baby Boomer,” two in three people enter retirement with little or no thought about what they want to actually do in retirement.

If you worry about your retirement investments during market downturns, you’re not alone. Unfortunately, emotions are often the enemy of sound investing. Here are some points to help you stay clear-headed during periods of market volatility.

Throughout your life, your financial needs will change and life insurance can help you meet some of those needs. But how much life insurance do you need? There are a number of approaches to help determine how much life insurance you should have. Here are three of those methods.